The Carbon Border Adjustment Mechanism is part of the EU’s plan to fight climate change and prevent “carbon leakage”. This is when companies move production to countries with lower environmental standards. To stop that, the EU is putting a carbon price on certain imports. That way, whether a product is made in Europe or abroad, it has to meet the same carbon standards.

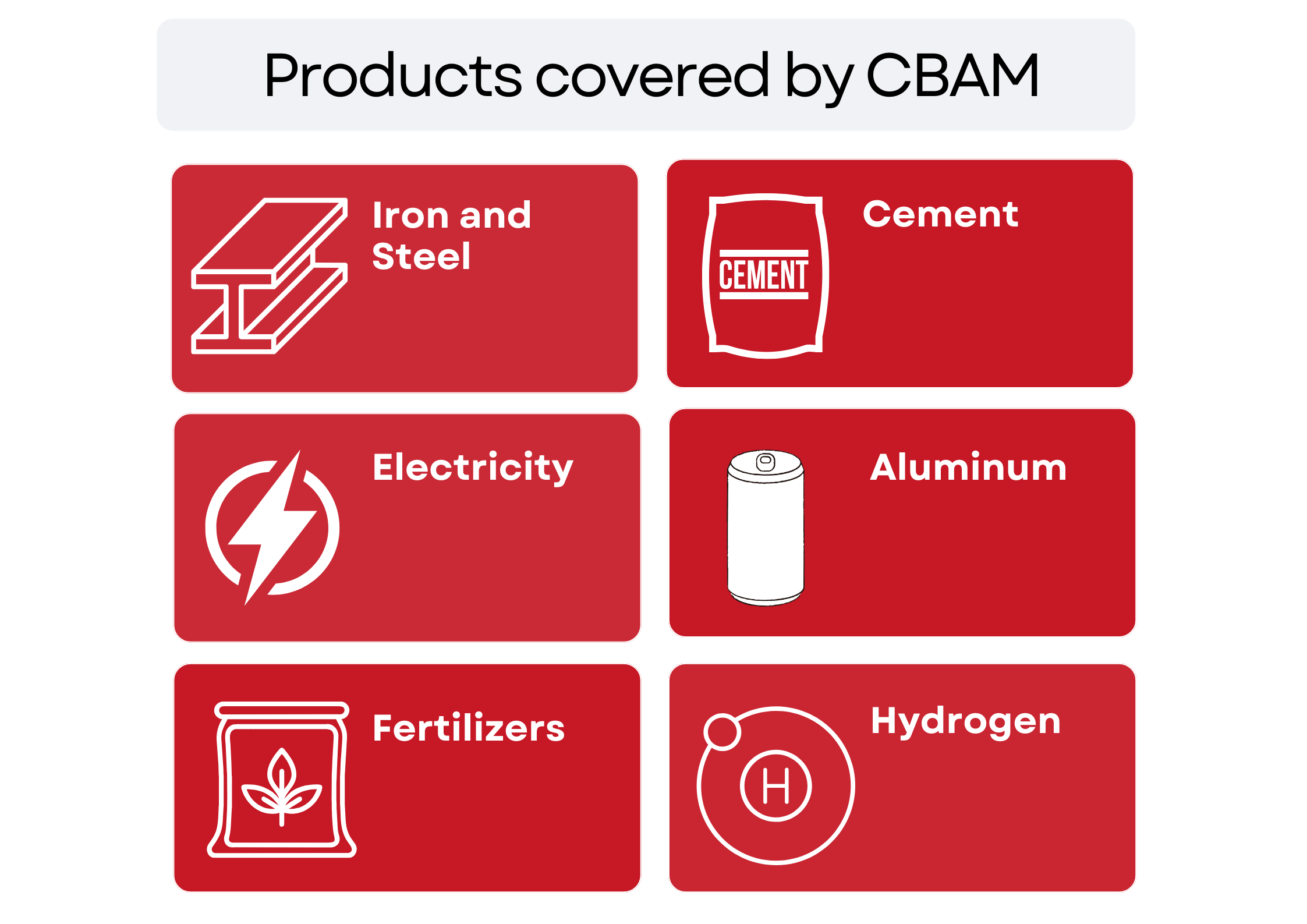

The European Union’s Carbon Border Adjustment Mechanism (CBAM) is being implemented in two distinct phases. The transitional phase, running from October 1, 2023, to December 31, 2025, requires importers of certain carbon-intensive goods—such as cement, iron and steel, aluminium, fertilizers, electricity, and hydrogen—to report the greenhouse gas emissions embedded in their imports on a quarterly basis.

Starting from January 1, 2026, the implementation phase will commence, mandating importers to buy and surrender CBAM certificates corresponding to the embedded emissions in their imported goods. The price of these certificates will be aligned with the weekly average of the EU Emissions Trading System (ETS) allowance prices, effectively placing a carbon cost on imports to match the EU’s internal carbon pricing .

If your company exports these to the EU, you’ll need to report the “embedded emissions” — basically, the greenhouse gases released while making your product.

HQTS CBAM Services

At HQTS, we offer comprehensive services to help your business adapt to these changes, ensuring compliance and mitigating risks associated with non-compliance.

CBAM Compliance Assessment

-

Identify goods subject to CBAM regulations

-

Determine the origin and classification of imports

-

Evaluate existing carbon pricing mechanisms in the country of origin

CBAM Report assurance:

- Independent verification of your emissions data to meet CBAM requirements.

- Document review, site visits, and interviews to confirm accuracy and traceability.

- Formal assurance statement to support your CBAM declaration.

Additional HQTS Services:

-

CBAM Calculation Services: Tailored data collection, calculation, and submission for relevant sectors/products.

-

CBAM Training: Helping companies understand CBAM rules and build internal carbon emissions accounting systems.

To learn more about HQTS CBAM report assurance services, speak to a member of our team now.